Blog > Why Would I Move with a 3% Mortgage Rate?

Should You Really Stay for the 3% Mortgage Rate? Let’s Take a Closer Look

If you’re one of the many homeowners locked into a 3% mortgage rate, it’s completely understandable to be hesitant about giving that up. Even if the idea of moving has crossed your mind, you might keep circling back to the same question: “Why would I walk away from that rate?”

But here’s the thing — when you focus solely on the rate, you might be sidelining your real needs without realizing it.

People Don’t Move for Mortgage Rates — They Move for Life

Most people don’t move because of financial calculations alone. They move because their lives change. Families grow. Kids leave for college. Jobs shift. Retirements begin. Needs evolve. So instead of asking, “Why would I give up this rate?” ask yourself this:

Where do you see yourself five years from now?

Take a moment to picture your future. Will your family grow or shrink? Are you approaching retirement? Are you already feeling cramped — or maybe like you have too much space? If your life might change, even slightly, then your housing needs might change, too.

And here’s why that matters: timing a move can make a big financial difference.

Home Prices Are Projected to Rise — Even Slowly, It Adds Up

Home Prices Are Projected to Rise — Even Slowly, It Adds Up

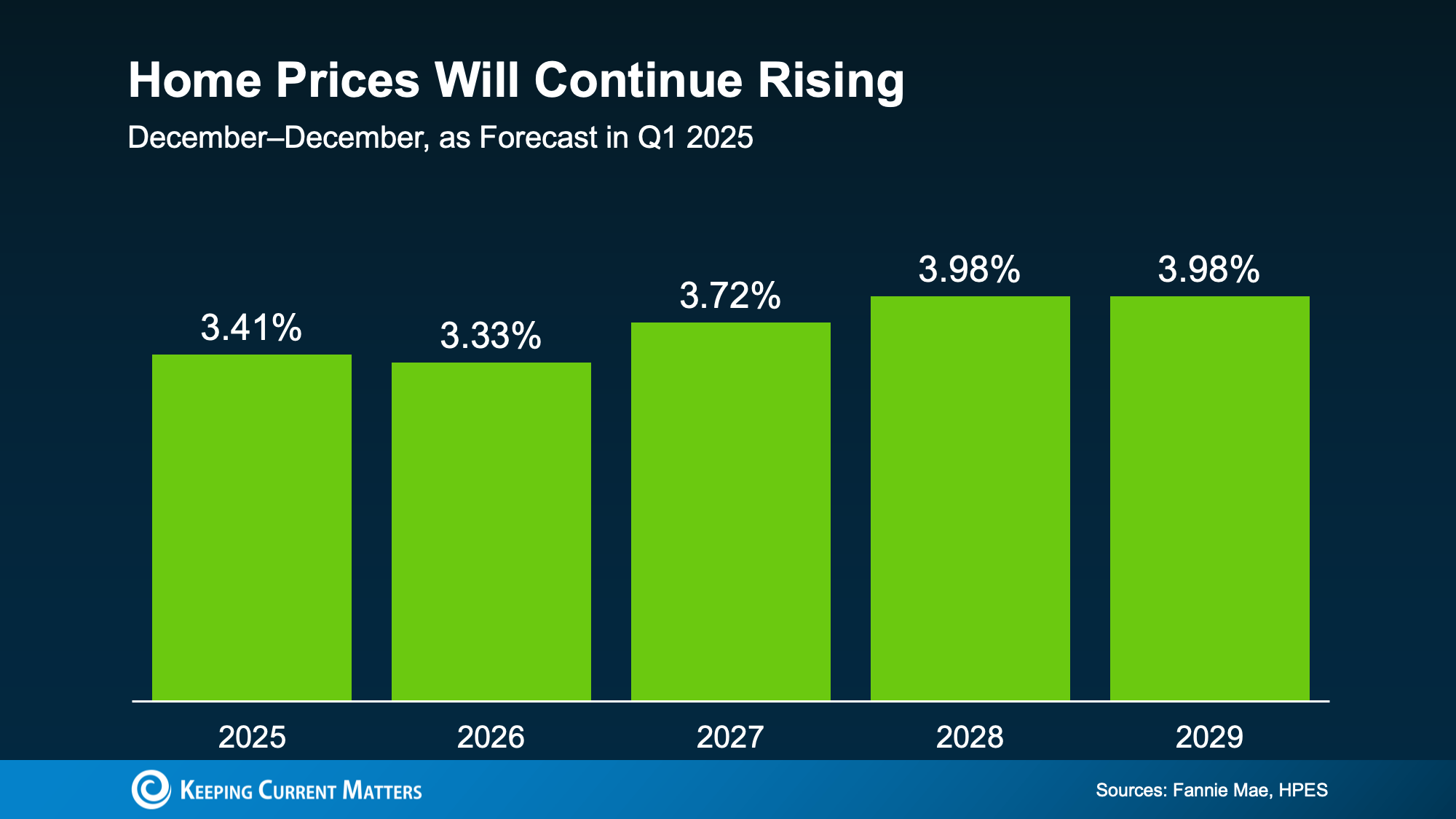

Each quarter, Fannie Mae surveys over 100 housing market experts about where home prices are headed. The consensus? Home values are expected to keep rising through at least 2029.

While annual increases may not be dramatic, steady appreciation can add up quickly.

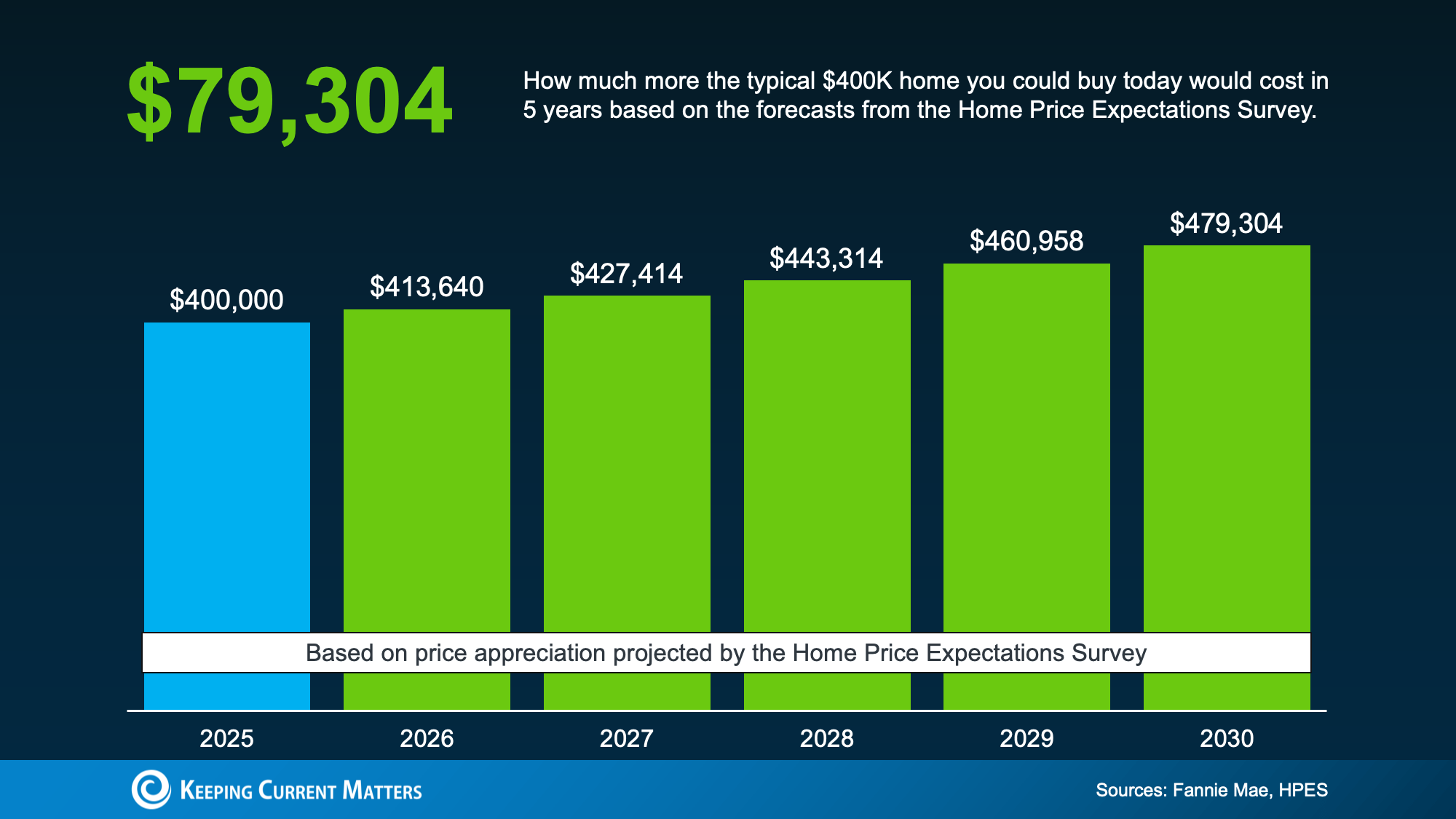

Let’s say you plan to buy a $400,000 home. If you wait five years, expert forecasts suggest that same home could cost around $480,000. That’s an $80,000 increase — just by waiting.

So if a move is even remotely on the horizon for you, now might be the right time to start planning — because homes aren’t likely to get more affordable in the long run.

What About Interest Rates?

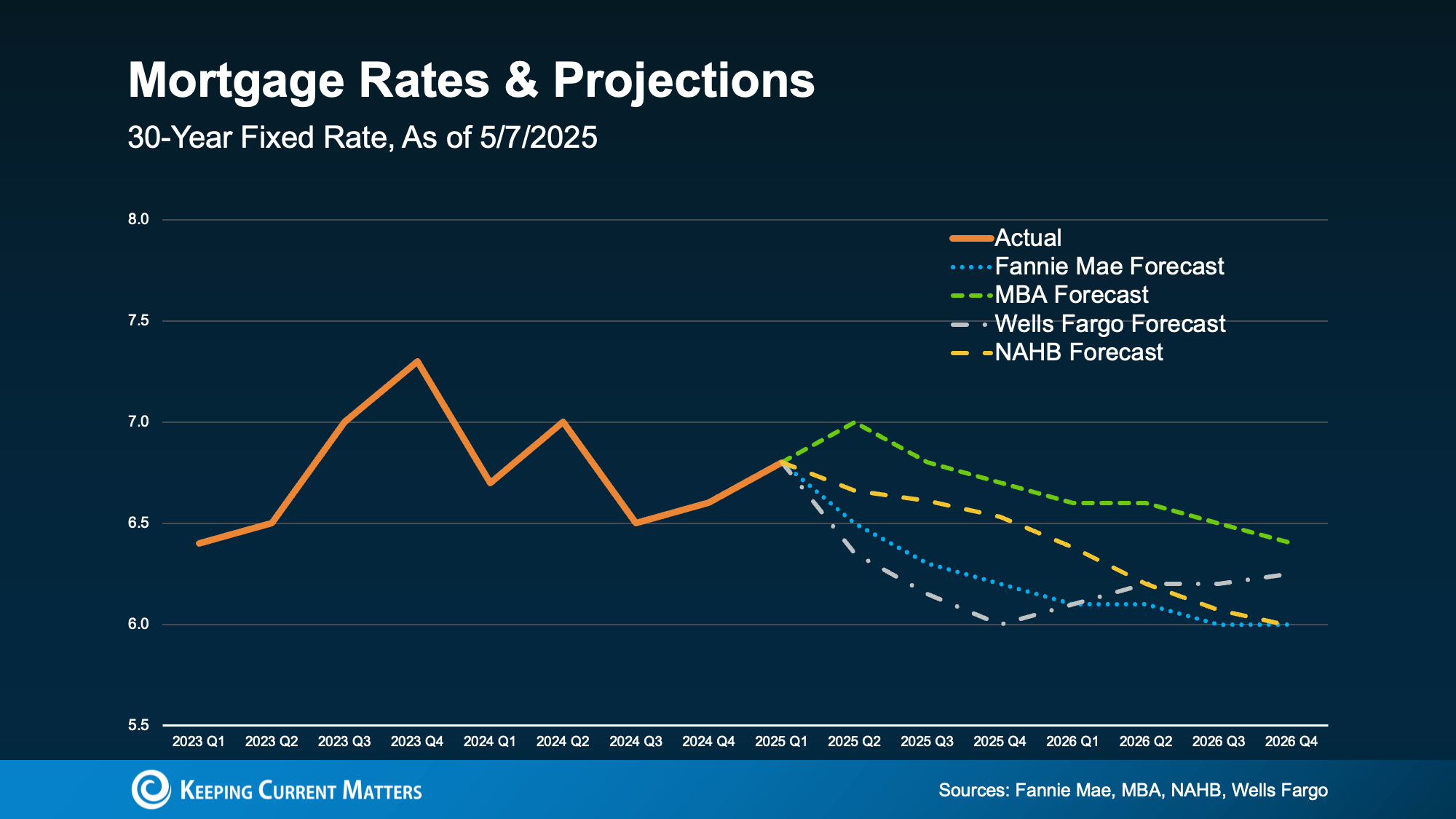

Yes, mortgage rates are higher than they were during the historic lows of 2020–2021. But holding out for 3% to return isn’t realistic. Experts across the board agree: while rates may decline modestly, we’re unlikely to see those record lows again anytime soon.

So if you're waiting for rates to "get better," be cautious — because in the meantime, prices could rise enough to wipe out any savings from a slightly lower rate.

The Real Question Isn’t “Why move?” — It’s “When?”

Staying put to keep a low rate makes sense — until it doesn’t.

If you know a move is coming at some point, whether it's one year or five, it’s worth having the conversation now. Talking through your goals with a trusted real estate advisor can help you understand how timing affects your bottom line — and whether it might be smarter to act sooner rather than later.

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

Bottom Line

Your 3% mortgage is a great deal — no doubt about it. But if holding onto it means putting your future plans on hold, it might be time to reconsider.

If there’s even a chance you’ll need to move in the next few years, thinking through your timeline today can help you make a more informed — and financially sound — decision tomorrow.